Sign In

Personal Banking & Small Business

- Tidal Business Checking

- Business Savings & CDs

- Personal Savings & CDs

Commercial Banking

- Business Plus Checking

- Business Plus Savings & CDs

- Treasury Management

Business Loans

- Manage Payments

- Get Statements

- Continue an Application

Resource Center / Grow My Business

How the Silver Tsunami Provides Acquisition Opportunities for Veterans

Written by Lisa Forrest

Our Ownership Transition Guide covers how to plan and execute an ownership transition.

Acquisition

Many Boomers do not have successors interested in taking over the family business and/or they need to sell their companies to realize their retirement. This is significant because it provides abundant opportunities for veterans interested in acquiring a business. There are many benefits to acquiring a business versus a startup, including utilizing existing infrastructure and having cash flow and profit from the beginning. Not to mention being your own boss.

Ample opportunity

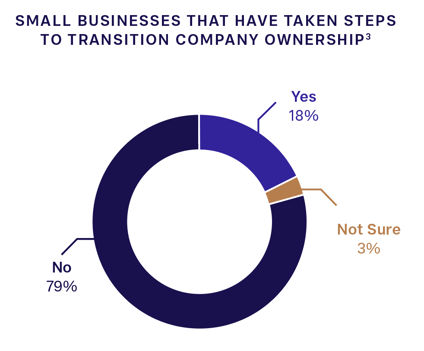

The latest statistics from Live Oak's research powered by Barlow state that “Nearly one in five of small business owners have already taken steps to transition ownership of their company” and “29% of small businesses anticipate an ownership transition within the next five years.”3 This shows untapped potential for America’s veterans to own a business.

-1.png?width=800&height=467&name=MicrosoftTeams-image%20(2)-1.png)

As previously stated, the need for the next generation of entrepreneurs to acquire these companies is heightened as family members are not interested in taking on ownership. Forbes has compiled several data points suggesting that the likely successors of some of these Baby Boomer-owned businesses may not be interested in taking over the family business.1 This disconnect in family succession offers a tremendous opportunity for transitioning military veterans to take up the mission of becoming the next generation of small business owners and CEOs.

Buying an existing business versus starting a new one has many benefits, such as an existing customer base, infrastructure and trained employees, to name a few.

Approximately 200,000 military members transition from active service to civilian life yearly (1,000,0000 every five years).4 According to the U.S. Census Bureau, there are over 7.9 small businesses in the U.S.5 and, as stated earlier, over 2.3 million (29%) of those businesses plan to transition in the next five years.3 That leaves ample opportunity for veterans looking to acquire businesses.

-1.png?width=608&height=334&name=MicrosoftTeams-image%20(1)-1.png)

Veteran entrepreneurs

According to recent data, veteran-owned firms employ 5.8 million individuals6 and veterans are 45% more likely to be self-employed than non-veterans.7

Military veterans have a highly valuable set of skills and abilities. Their military-gained skill sets compensate for what they might lack in industry-specific knowledge or experience. For example, they might be inexperienced in areas such as the deal process but have ample operational capacity from literal “boots on the ground” expertise in operating units. This translates to ‘business’ unit operations. Owning a small business also impacts your community and the nation, considering small businesses employ roughly half of the U.S. workforce.8 Running a small business and providing employment opportunities for Americans is a way that veterans can continue their ‘acts of service,’ which is a passion for many service men and women.

Scott Jensen, Executive Director of the NVSBC9 has this opinion, “Veterans have all the qualities, experience, and expertise to make incredibly successful business owners. Historically, they achieved a higher success level than non-veteran-owned companies. And, despite what they think, they don’t have to have an MBA or be a graduate of a fancy university to succeed! ”Further, “Unfortunately, many lack the knowledge or confidence to leverage what they inherently already possess to run a company and prove to themselves that they can succeed. Conventional wisdom among most veterans is that they must start from scratch and that they have to self-fund their endeavors. Growing the ecosystem of trusted education, resources, services, and information related to VETSETA is vital to getting veterans—who are inherently postured for success. They need to understand how to acquire an existing company and that there or good people and organizations out there that can and want to help them find the financial resource (access to capital) to make that dream come true.”

At Live Oak Bank, we specialize in business acquisition financing, and we have lenders dedicated to helping you navigate the deal process, from assessing acquisition opportunities to due diligence and closing. We are with you every step of the way. We have expertise in a wide range of industries as well as a team that specializes in entrepreneurship through acquisition; connect with a lender today!

1. Hall, Mark. “Unsexy But Thriving Businesses: The Hidden Opportunity Gifted To Us By Baby Boomers.” Forbes, 25 Jan 2022, https://www.forbes.com/sites/markhall/2022/01/25/unsexy-but-thriving-businesses-the-hidden-opportunity-gifted-to-us-by-baby-boomers/?sh=6322c5864620. Accesses 4 October 2022.

2. “Boomers in Business –2020 Trends.” Guidant, https://www.guidantfinancial.com/small-business-trends/baby-boomer-business-trends/. Accessed 5 October 2022.

3. “Business Pulse Third Quarter 2022.” Live Oak Business Pulse powered by Barlow Research Associates, Inc., https://info.liveoakbank.com/businesspulse. Accessed 5 October 2022.

4. “Transitioning Service members: Information on Military Employment Assistance Centers.” U.S. Government Accountability Office, https://www.gao.gov/products/gao-19-438r. Accessed 5 October 2022.

5. Grundy, Adam. “U.S. Census Bureau Resources, Data Tools, New Website for Small Businesses.” United States Census Bureau, https://www.census.gov/library/stories/2022/05/how-small-businesses-impact-economy.html. Accessed 5 October 2022.

6. “Facts on Veterans and Entrepreneurship.”Invest in Veterans Weekly, https://investinveteransweek.com/about#:~:text=The%20U.S.%20Small%20Business%20Administration,firms%20employ%205.8%20million%20individuals. Accessed 5 October 2022.

7. “Veteran Resources." Office of Small Business Programs Department of Defense, https://business.defense.gov/Work-with-us/SDVOSB/Veterans-Resources/#:~:text=Veterans%20are%2045%20percent%20more,ideally%20suited%20to%20become%20entrepreneurs. Accessed 5 October 2022.

8. The State of Small Business Now.” The U.S. Chamber of Commerce, https://www.uschamber.com/small-business/state-of-small-business-now#:~:text=Key%20Takeaways,of%20America's%20private%20sector%20workforce. Accessed 5 October 2022.

9. Scott Jensen, Executive Director of the NVSBC, office: 703-889-5742, www.nvsbc.org

Subscribe via Email

We're committed to your privacy. Live Oak Bank uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our privacy policy.